Top-Rated Health Insurance Companies in UAE: Your Guide to Trusted Coverage

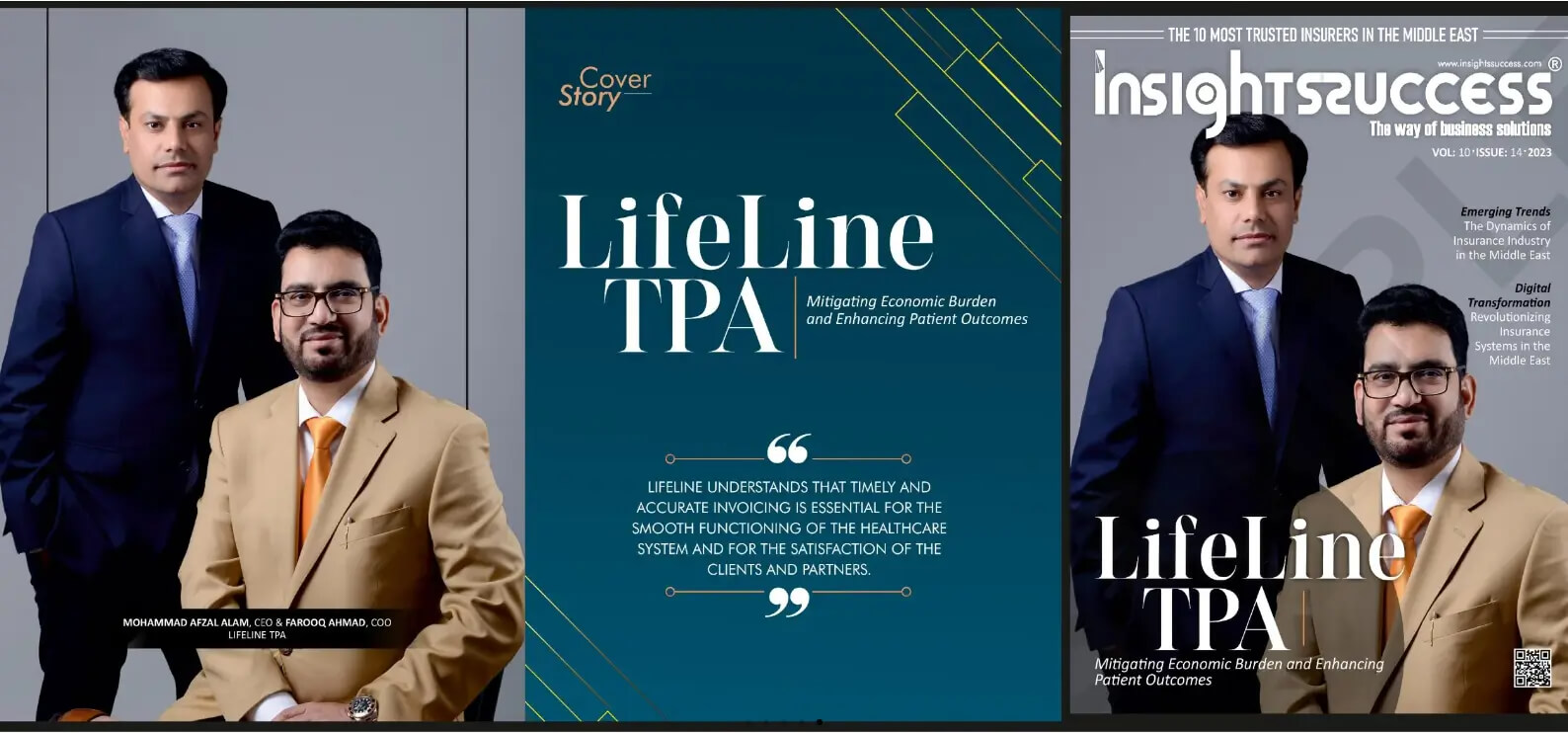

In today’s fast-paced world, health security is not just a necessity—it’s peace of mind. Choosing the right insurance partner ensures that individuals and businesses alike receive timely medical support, reliable coverage, and financial stability in times of need. Across the UAE, the healthcare landscape continues to evolve, with insurers offering flexible and transparent plans that cater to diverse needs. Among these, LifeLine TPA stands out as a trusted partner offering efficient, ethical, and customer-centric insurance management services across the region.

Best Health Insurance Companies in UAE

When it comes to the best health insurance companies in UAE, customers look for reliability, transparency, and efficiency. These leading providers are known for their wide hospital networks, flexible plans, and fast claims processing. They partner with organizations like LifeLine TPA to streamline claims, ensure fair settlements, and improve member satisfaction. UAE-based insurers have set global benchmarks for quality healthcare coverage, making the region one of the most insured populations in the Middle East. Whether you need individual, family, or group insurance, choosing a TPA that works with top insurers ensures hassle-free access to premium healthcare facilities nationwide.

Life Line Insurance: A Partner in Your Health Journey

Life Line Insurance embodies trust, transparency, and commitment to service excellence. Established in 2015, LifeLine TPA (Khat Al Haya Management of Health Insurance Claims LLC) has built a reputation as one of the UAE’s most reliable third-party administrators. With operations in the UAE, Oman, and Turkey, the company manages every step of the insurance process—from claims adjudication to policy maintenance—with integrity and precision.

Their extensive experience in claims management, customer support, and provider networking ensures every client receives seamless service. LifeLine TPA also offers 24/7 assistance, ensuring that insured members can access support any time of the day. Its professional team includes medical experts, insurance specialists, and dedicated administrators who prioritize members’ well-being.

What Is PPN in Insurance?

If you’re new to the world of insurance, you might wonder, “What is PPN in insurance?” The term PPN stands for Preferred Provider Network—a list of healthcare providers, such as hospitals and clinics, that have partnered with an insurance company or TPA to offer cashless or discounted medical services. When you visit a provider within this network, you can often receive treatment without paying upfront, as the TPA directly handles the billing and settlement.

PPNs play a crucial role in managing healthcare costs efficiently while ensuring quality care. LifeLine TPA’s vast provider network across the GCC ensures that members enjoy wide access to trusted healthcare professionals under one umbrella. This network-driven model enhances convenience and ensures that customers always receive high-quality, affordable care.

Insurance Inquire: How to Make the Right Decision

Before choosing an insurer, it’s important to insurance inquire about the available options. This means comparing coverage plans, claim settlement ratios, provider networks, and customer reviews. A well-informed inquiry allows individuals and organizations to choose the right coverage that fits their budget and healthcare needs.

LifeLine TPA simplifies this process by offering transparent information, easy-to-use digital tools, and expert guidance. Their online portals and mobile apps empower members to track claims, manage plans, and make informed decisions—all from the comfort of their home or office. With its dedication to honest communication and customer empowerment, LifeLine TPA continues to redefine how people experience health insurance management in the UAE.

Why Choose LifeLine TPA

Choosing the right TPA can make all the difference in the insurance experience. LifeLine TPA is built on three pillars—transparency, reliability, and innovation. With over 10 years of expertise, the company delivers a comprehensive suite of services, including:

- Claims Management: Automated processing powered by intelligent adjudication rules, reducing manual intervention and ensuring accuracy.

- Customer Service: A 24/7 call center that ensures rapid assistance and precise information for members.

- Network Management: Extensive partnerships with hospitals, clinics, and pharmacies for cashless access and hassle-free care.

- Fraud Control: Effective monitoring systems to detect and prevent misuse or false claims.

- Training and Development: Continuous upskilling of staff to enhance service quality and operational excellence.

Their proactive approach and commitment to building long-term relationships with insurance partners and healthcare providers reflect their dedication to quality service. Every process—from claim initiation to final settlement—is handled with transparency, accuracy, and care.

A Vision for Global Expansion

LifeLine TPA vision extends beyond borders. With a growing presence in Oman and Turkey, the company continues to strengthen its footprint across the GCC and international markets. The focus remains on delivering satisfactory TPA services globally, enabling insurers and clients to experience a smooth and dependable insurance management system.

By leveraging technology and data-driven insights, LifeLine TPA is shaping the future of third-party administration in health insurance. Its partnerships with leading insurers ensure that members receive consistent and reliable services that enhance both trust and convenience.

Conclusion: Trust, Transparency, and Care

In conclusion, the best health insurance companies in UAE succeed because they work hand in hand with reliable TPAs like LifeLine. These partnerships ensure customers receive fair settlements, transparent communication, and uninterrupted access to quality healthcare. LifeLine TPA’s decade-long expertise, wide provider network, and commitment to ethical practices make it a name synonymous with trust in the UAE insurance industry.